FIDUCIARY-ONLY ASSET MANAGEMENT

Managing your money in your best interest.

Asset management isn't only about growing wealth—it's about aligning your investments with your life's goals, values, and long-term direction

Why Asset Management Matters

In today's complex financial landscape, successful wealth management extends far beyond simple investment selection. It requires a comprehensive understanding of your unique circumstances, a commitment to fiduciary principles, and the expertise to navigate ever-changing market conditions.

Alignment Over Assets

We clear away the clutter of market noise to focus on what truly matters: your financial priorities and well-being. Our approach prioritizes understanding your life goals before making any investment decisions.

Active, Fiduciary-Driven Oversight

Our role as a fiduciary ensures every decision is made with your best interest in mind—no transaction-based biases, just transparent, client-first stewardship of your portfolio.

Confidence Through Flexibility

With active management across asset allocation, risk calibration, and tax strategies, you can trust your investments are optimized as your life evolves and circumstances change.

Our Structured Investment Process

Our five-step methodology covers every aspect of your financial life is carefully considered and strategically aligned. This comprehensive approach transforms complex financial decisions into clear, actionable steps that move you confidently toward your goals.

Discovery & Goal Clarification

We begin by understanding your unique situation, values, and aspirations. Through detailed conversations and comprehensive analysis, we establish clear, measurable objectives that reflect your vision for the future.

1

Scenario Modeling & Projections

Using sophisticated modeling tools, we analyze various scenarios and their potential outcomes. This process reveals opportunities and potential challenges, allowing us to stress-test strategies before implementation.

2

Investment & Asset Strategy

We develop a customized investment approach that aligns with your risk tolerance, time horizon, and goals. Our strategies integrate tax efficiency, diversification, and cost management principles.

3

Tax & Estate Coordination

Our team coordinates with your existing professionals to optimize tax strategies and ensure your estate planning reflects your current wishes and financial situation.

4

Review & Adapt

Your financial plan evolves with your life. We conduct regular reviews and adjustments to ensure your strategy remains aligned with changing circumstances and market conditions.

5

Our Team at Work

Investment Strategist

Crafts and maintains your portfolio with discipline and insight, leveraging decades of market experience to identify opportunities and manage risk.

Risk & Asset Alignment Specialist

Diversification helps us align your comfort and goals, continuously monitoring portfolio balance and making adjustments as needed.

Tax Efficiency Advisor

Collaborates with your tax professionals to optimize returns net of taxes, implementing sophisticated strategies like tax-loss harvesting and strategic asset location.

Client Relations & Reporting Coordinator

Keeps you informed and confident with clear updates and proactive communication, ensuring you always understand your portfolio's performance and strategy.

Your Pathways Forward

Every investor's journey is unique, which is why we offer multiple strategic approaches tailored to your specific circumstances, goals, and preferences. Our flexible framework adapts to serve both conservative wealth preservation and aggressive growth objectives.

Core Portfolio Strategy

A balanced foundation built on stability, diversification, and long-term growth. This approach provides steady wealth accumulation through carefully selected, time-tested investment principles and broad market exposure.

Dynamic Active Management

For clients who prefer responsive adjustments tuned to market and economic signals. This strategy allows for tactical allocation changes and opportunistic investments while maintaining disciplined risk management.

Tax-Aware Portfolio Optimization

Integrating tax-loss harvesting and strategic allocation alongside broader financial planning. This approach maximizes after-tax returns through sophisticated tax management strategies.

Retirement-Focused Strategy

Designed to transition from accumulation to income generation with smooth rebalancing. This pathway ensures your portfolio evolves to meet changing needs as you approach and enter retirement.

Stay Informed—Insights & Resources

We believe informed clients make better financial decisions, which is why we provide comprehensive educational resources and market insights to help you understand the forces shaping your portfolio.

What Issues Should I Consider When Reviewing My Investments?

This guide provides a structured checklist to help you evaluate your investment objectives, risk tolerance, asset allocation, tax considerations, and overall portfolio strategy to ensure your investments remain aligned with your goals.

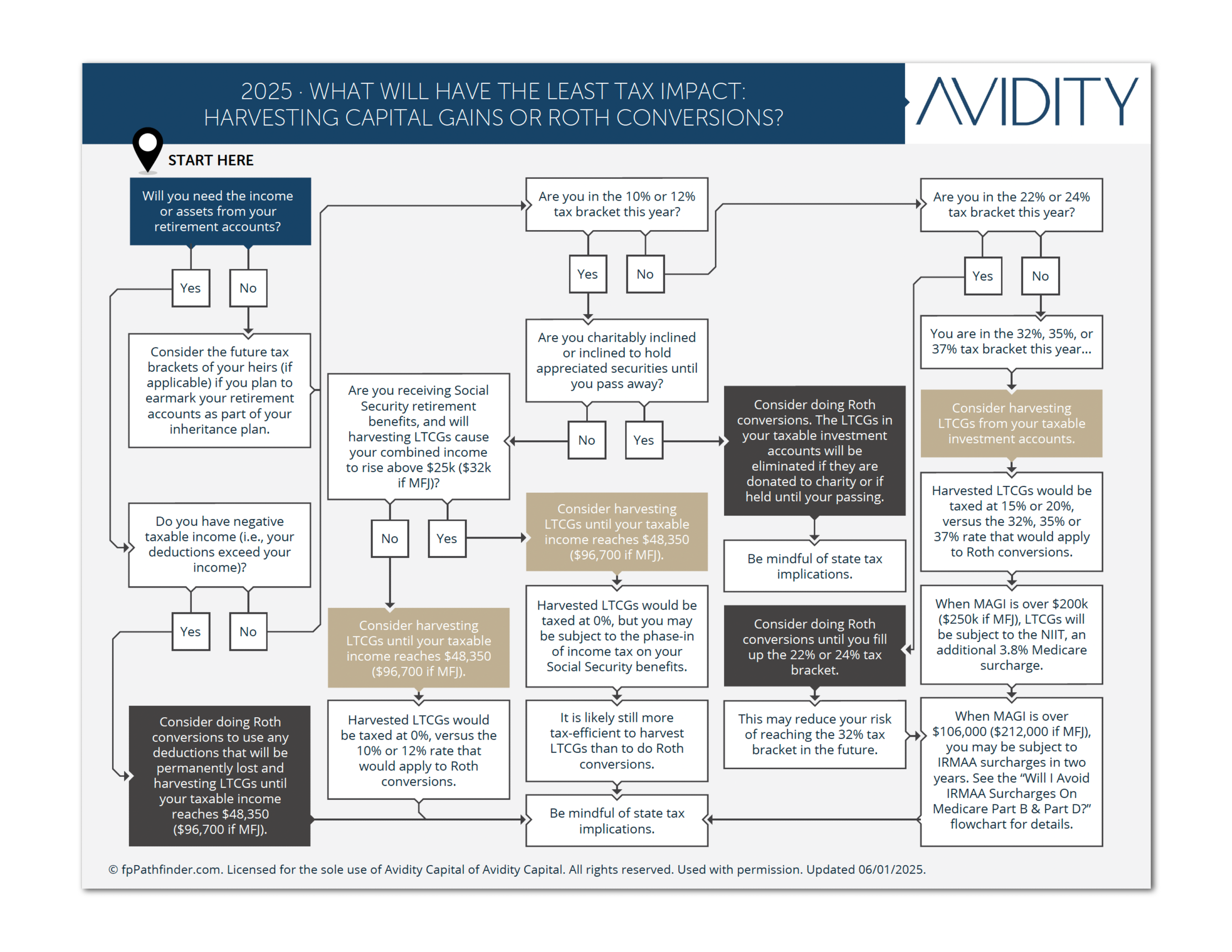

What Will Have the Least Tax Impact: Harvesting Capital Gains or Roth Conversions?

This guide helps you compare the tax implications of harvesting long-term capital gains versus making Roth conversions, so you can decide which strategy best minimizes taxes based on your income, bracket, and financial goals.

Will I Have to Pay Tax on the Sale of My Investment?

This guide walks you through the factors that determine whether selling an investment will trigger federal, state, or additional taxes, helping you understand capital gains treatment, income thresholds, and potential tax liabilities.

These resources help clients understand the foundations of asset management and stay engaged with their financial journey.

Frequently Asked Questions

Managing wealth can raise a lot of questions, from how portfolios are built to how often they’re reviewed. Our FAQs below address the most common concerns about fiduciary asset management and how Avidity Capital helps align your investments with your goals.

What does “fiduciary-only asset management” mean?

It means we act in your best interest at all times—no commission-based sales, no conflicts of interest—only transparent decisions intended to align your investments with your goals and risk tolerance.

What kinds of fees are involved, and how are they structured?

Fees are transparent and typically asset-based; you’ll know up front what you’re paying for portfolio management. There are no hidden commissions or unexpected charges—just clear, consistent fee arrangements.

How frequently will you review and adjust my portfolio?

We regularly monitor your portfolio and perform reviews at least annually—or sooner if there are major changes in the market, tax laws, or your personal circumstances.

Contact Our Firm