COMPREHENSIVE FINANCIAL PLANNING

Planning for the future you desire.

Financial planning isn’t just about managing money—it’s about aligning your resources with the life and legacy you envision.

Why Comprehensive Planning Matters

In today's complex financial landscape, navigating major life decisions requires more than basic investment advice. Comprehensive financial planning provides the strategic framework you need to make informed decisions with confidence, ensuring every aspect of your financial life works in harmony toward your ultimate goals.

Life Milestones

Whether you're planning for retirement, funding your children's education, or navigating a career transition, we help you approach major life changes with strategic clarity and financial confidence.

Financial Clarity

Gain a comprehensive understanding of your current financial position and a clear roadmap to your future objectives. No more guesswork—just strategic, data-driven planning.

Protect What Matters

Preserve your lifestyle and legacy through coordinated risk management, tax optimization, and estate planning strategies that adapt as your life evolves.

Our Tailored Planning Process

Our five-step methodology covers every aspect of your financial life is carefully considered and strategically aligned. This comprehensive approach transforms complex financial decisions into clear, actionable steps that move you confidently toward your goals.

Discovery & Goal Clarification

We begin by understanding your unique situation, values, and aspirations. Through detailed conversations and comprehensive analysis, we establish clear, measurable objectives that reflect your vision for the future.

1

Scenario Modeling & Projections

Using sophisticated modeling tools, we analyze various scenarios and their potential outcomes. This process reveals opportunities and potential challenges, allowing us to stress-test strategies before implementation.

2

Investment & Asset Strategy

We develop a customized investment approach that aligns with your risk tolerance, time horizon, and goals. Our strategies integrate tax efficiency, diversification, and cost management principles.

3

Tax & Estate Coordination

Our team coordinates with your existing professionals to optimize tax strategies and ensure your estate planning reflects your current wishes and financial situation.

4

Review & Adapt

Your financial plan evolves with your life. We conduct regular reviews and adjustments to ensure your strategy remains aligned with changing circumstances and market conditions.

5

Your Multidisciplinary Team

Complex financial challenges require diverse expertise. Our collaborative approach brings together specialists from multiple disciplines, ensuring every aspect of your financial life receives expert attention and strategic coordination.

-

Develops and manages portfolio strategies tailored to your specific risk profile, return objectives, and time horizon, with ongoing monitoring and rebalancing.

-

Optimizes tax efficiency across your entire financial plan while ensuring estate planning strategies protect and transfer wealth according to your wishes.

-

Evaluates and manages various risks to your financial security, recommending appropriate insurance coverage and risk mitigation strategies.

-

Focuses on retirement income strategies and legacy planning, ensuring your financial resources support your desired lifestyle throughout retirement and beyond.

Rather than working with multiple advisors who may not communicate effectively, our integrated team model ensures seamless coordination across all areas of your financial life. Each specialist brings deep expertise while maintaining awareness of how their recommendations impact your overall strategy.

Comprehensive Planning Solutions

Every client's situation is unique, which is why we offer tailored planning solutions designed to address specific life stages, goals, and challenges. Our comprehensive approach ensures all aspects of your financial life work together harmoniously.

Comprehensive Wealth Plan

Our flagship offering integrates all aspects of financial planning into a cohesive strategy. Ideal for individuals and families with complex financial situations requiring ongoing coordination across multiple areas.

Complete financial analysis and goal setting

Investment management and tax optimization

Risk management and estate planning coordination

1

Retirement Transition Strategy

Specialized planning for those approaching or entering retirement, focusing on income sustainability, healthcare planning, and lifestyle preservation throughout your golden years.

Retirement income optimization

Healthcare cost planning and long-term care strategies

Social Security and Medicare decision support

2

Education & Accumulation Planning

Strategic planning for families building wealth while preparing for education expenses, combining growth strategies with education funding solutions.

529 plan optimization and education funding strategies

Tax-efficient wealth accumulation approaches

Family financial education and planning

3

Legacy & Estate Focused Planning

Advanced strategies for high-net-worth individuals focused on wealth preservation, tax minimization, and efficient wealth transfer to future generations.

Advanced estate planning strategies

Charitable giving and foundation planning

Multi-generational wealth transfer techniques

4

Looking for a Different Approach?

Not everyone needs—or wants—a full comprehensive financial plan right away. That's why we built Avidity Journey: a subscription-based model designed for people who want access to a financial advisor, actionable financial steps, and the flexibility to DIY parts of the process.

Weekly Financial Insights

Receive actionable guidance delivered in digestible weekly segments, allowing you to progress at your own pace while building financial confidence.

Flexible Advisor Access

Choose when to engage directly with our advisors or keep it self-directed. You maintain control over your planning timeline and interaction level.

Professional-Grade Tools

Utilize the same planning tools and proven strategies we use with comprehensive clients, adapted for a more flexible engagement model.

It's an ideal solution if you're early in your financial journey, want guidance without complexity, or prefer a lower-commitment way to engage with an advisor.

Stay Informed—Insights & Resources

We believe informed clients make better financial decisions, which is why we provide comprehensive educational resources and market insights to help you understand the forces shaping your portfolio.

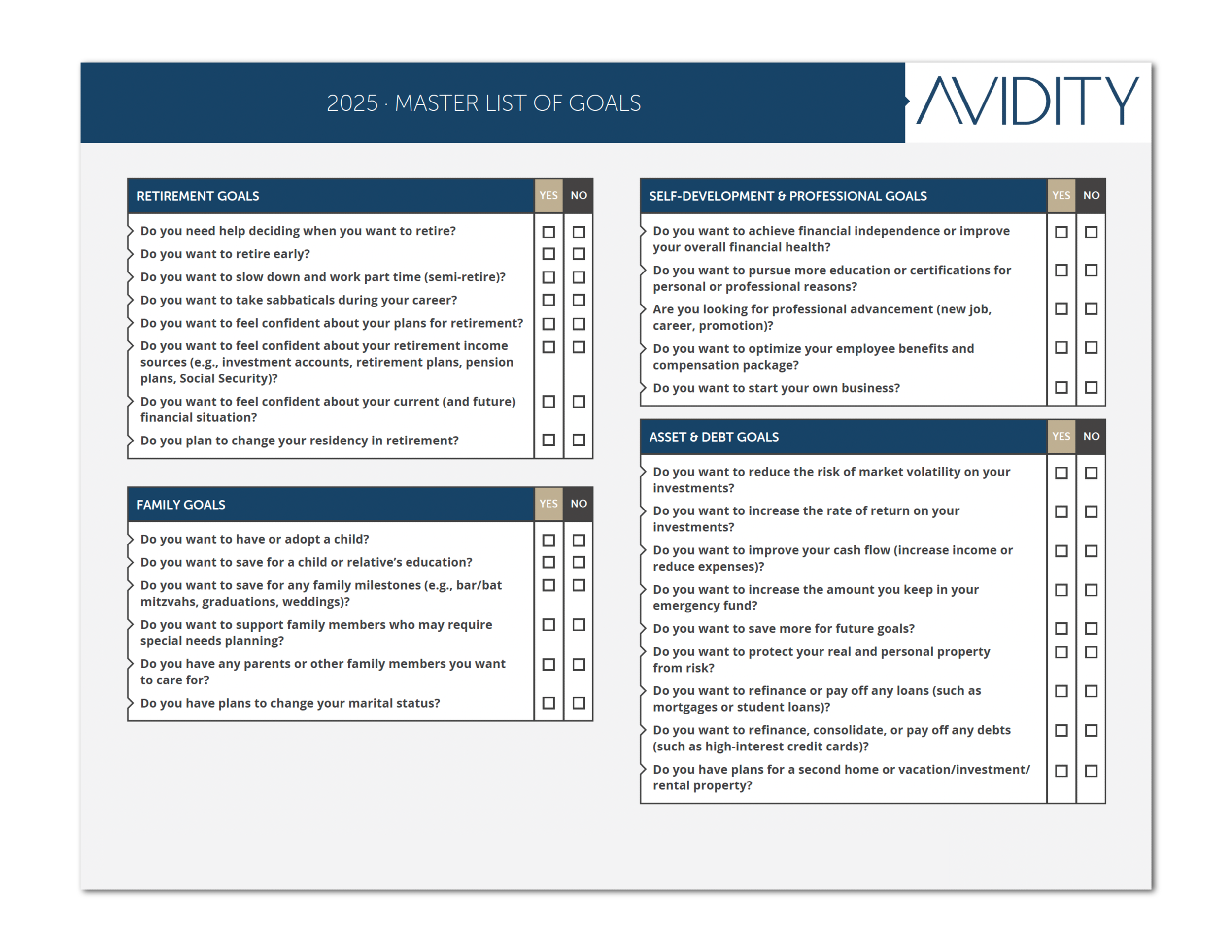

Master List of Goals

This is a comprehensive checklist designed to help you clarify priorities across retirement, family, lifestyle, tax, and estate planning. Use it as a starting point to define your vision and take the next step toward financial clarity.

Will I Avoid IRMAA Surcharges on Medicare Part B & Part D?

Understanding how Medicare surcharges (IRMAA) may impact your retirement income is critical. This guide walks you through the income thresholds, potential surcharges, and exceptions that could affect your Part B and Part D premiums.

What Issues Should I Consider When Creating My Estate Plan?

Creating an estate plan involves more than just writing a will. This guide highlights key issues—from guardianship and medical directives to probate, taxes, and asset transfers—so you can make informed decisions and protect your family’s future.

Frequently Asked Questions

Have questions about financial planning? We’ve gathered the most common ones below to help you understand our process, what to expect, and how Avidity Capital can support your financial goals.

What does “financial planning” include?

We act strictly as fiduciaries, meaning we only work in your best interest. We also quarterback the entire process, coordinating attorneys, CPAs, qualified intermediaries, and DST providers so nothing is left to chance.

How are your fees structured?

We operate on a transparent fee model.

– One-Time Plan: $6,000

– On-Going Family CFO: $17,500/annually

– On-Going CFO + Family Summits: $26,000/annually

*Does NOT include investment management fee

How do you coordinate with my CPA or estate attorney?

We believe good financial planning works best when your team of professionals is in sync. We’ll collaborate with your CPA, estate attorney, or other trusted advisors to ensure taxes, estate documents, and investment strategies work together to support your goals.